Affirm tells you up front the total amount you'll pay. That number will never go up.

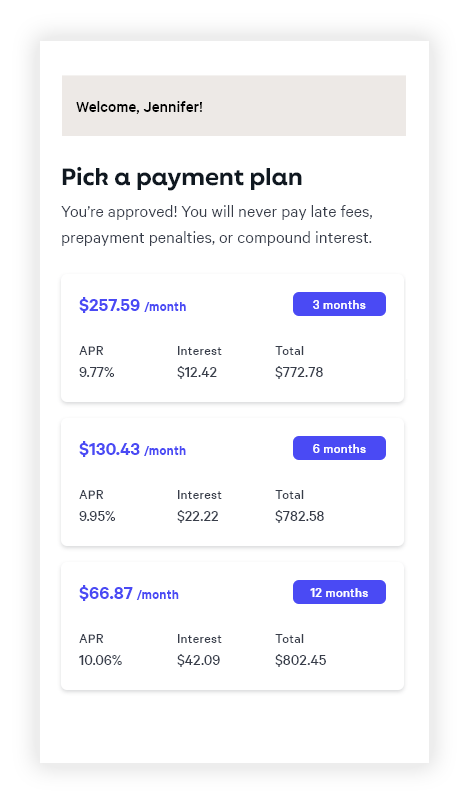

You choose the payment schedule that works for you.

Affirm won't charge you late fees or penalties of any kind, ever.

Frequently Asked Questions

To sign up for Affirm, you must:

- Be 18 years or older (19 years or older in Alabama or if you're a ward of the state in Nebraska).

- Provide a valid U.S. or APO/FPO/DPO home address.

- Provide a valid U.S. mobile or VoIP number and agree to receive SMS text messages. The phone account must be registered in your name.

- Provide your full name, email address, date of birth, and the last 4 digits of your social security number to help us verify your identity.

Affirm loan-application process steps:

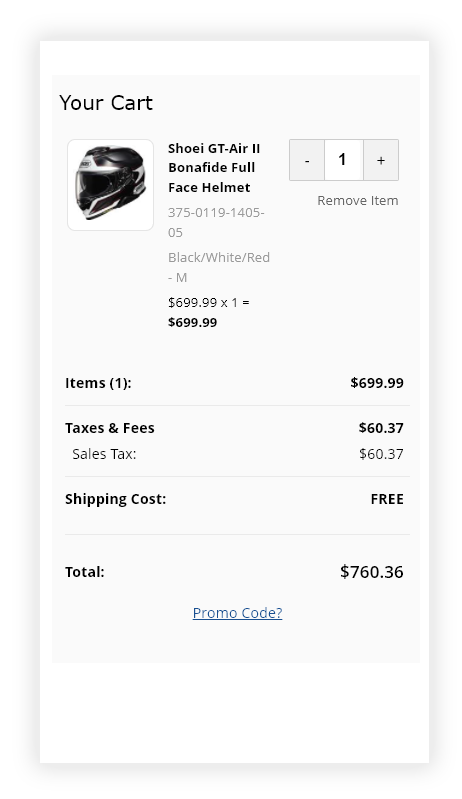

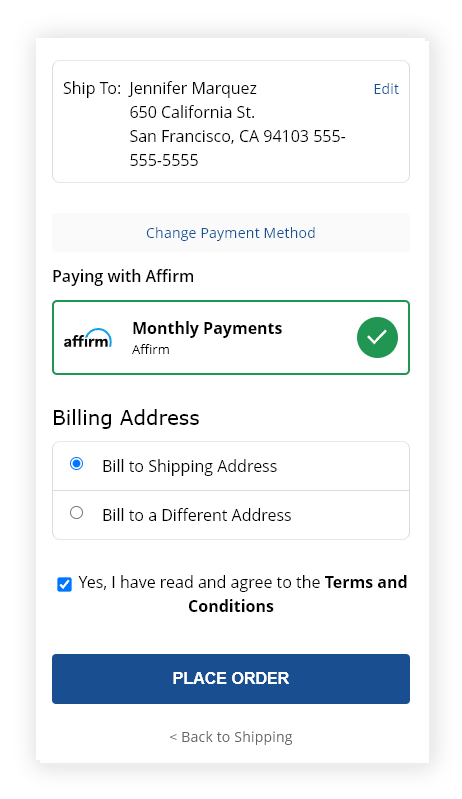

- At checkout, choose Pay with Affirm.

- Affirm prompts you to enter a few pieces of information: Name, email, mobile phone number, date of birth, and the last four digits of your social security number. This information must be consistent and your own.

- To ensure that you're the person making the purchase, Affirm sends a text message to your cell phone with a unique authorization code.

- Enter the authorization code into the application form. Within a few seconds, Affirm notifies you of the loan amount you're approved for, the interest rate, and the number of months you have to pay off your loan. You have the option to pay off your loan over three, six, or twelve months. Affirm states the amount of your fixed, monthly payments and the total amount of interest you'll pay over the course of the loan.

- To accept Affirm's financing offer, click Confirm Loan and you're done.

After your purchase, you'll receive monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment is due 30 days from the date that we (the merchant) processes your order.

Affirm discloses your exact monthly payment up front, before you agree to finance your purchase with Affirm. There are no annual fees or other hidden fees.

Yes! Affirm works hard to be completely transparent. You'll see the amount of interest you'll owe on the terms page and again on the loan confirmation page. If you pay off your loan early, you'll receive a rebate for any interest that hasn't yet accrued.

Before each payment is due, Affirm sends you an email or SMS reminder with the installment amount that is coming due and the due date. You have the option to sign up for autopay, so you don't risk missing a payment.

Follow these steps to make a payment:

- Go to www.affirm.com/account.

- Enter your mobile phone number. Affirm sends a personalized security PIN to your phone.

- Enter this security PIN into the form on the next page and click Sign in.

- After you sign in, a list of your loans appears, with payments that are coming due. Click the loan payment you would like to make.

- Make a payment using a debit card or ACH bank transfer.

A refund posts to your Affirm account if we process your refund request. In the event that we issue you store credit instead of a refund, you are still responsible for paying off your Affirm loan.

If you have already made loan payments or a down payment, Affirm issues a refund credit to the bank account or debit card that you used to make the payments.

Paid interest

We do not refund any paid interest.

Affirm has a dedicated team on staff in their US-based headquarters to assist you with your account. They can be reached via email at help@affirm.com.